cryptocurrency tax calculator uk

Uses your cryptocurrency transaction history to generate a Schedule easily. How do cryptocurrency taxes work.

![]()

Cointracking Crypto Tax Calculator

Whilst cryptocurrency is a relatively new asset the regulations surrounding it are still being formed.

. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Let us handle the formalities. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

BittyTax is a collection of command-line tools to help you calculate your cryptoasset taxes in the UK. You have investments to make. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins.

Subtract your Capital Gains Tax Allowance 12300 from your total taxable gains. You can gift up to 11300 of assets to your spouse and use their capital gains tax allowance thereby getting up to 22600 of capital gains tax free annually. Additionally for each sale or exchange you will need the following information.

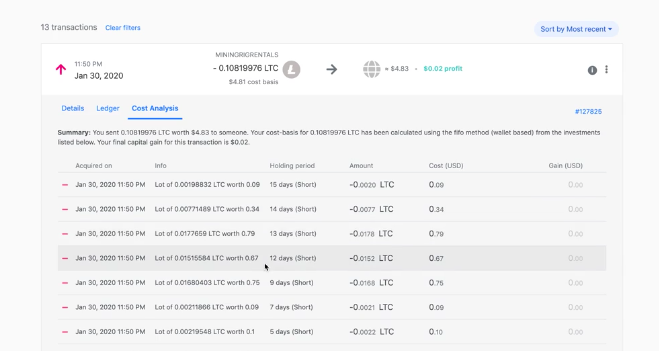

Since then its developers have been creating native apps for mobile devices and other upgrades. ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

Crypto tax breaks. UK crypto tax basics. This allowance was 12500 for the 20202021 tax year.

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. This is known as a Capital Gains Tax and has to be paid in most countries such as the USA UK Canada etc.

Stay focused on markets. UK crypto investors can pay less tax on crypto by making the most of tax breaks. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

12570 Personal Income Tax Allowance. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting. However exchange of one cryptocurrency for another will also be considered disposal.

Weve collected some useful links in the Resources section at the end. So is there a crypto tax in the UK. It also offers a corporate version for businesses accountants and accounting firms.

Our capital gains tax rates guide explains this in more detail. HMRC has published guidance on this. You pay 127 at 10 tax rate for the next 1270 of your capital gains.

Add the remaining amount to your taxable income. However when it comes to taxing them it depends on how the tokens are used. If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of your crypto taxes are in order.

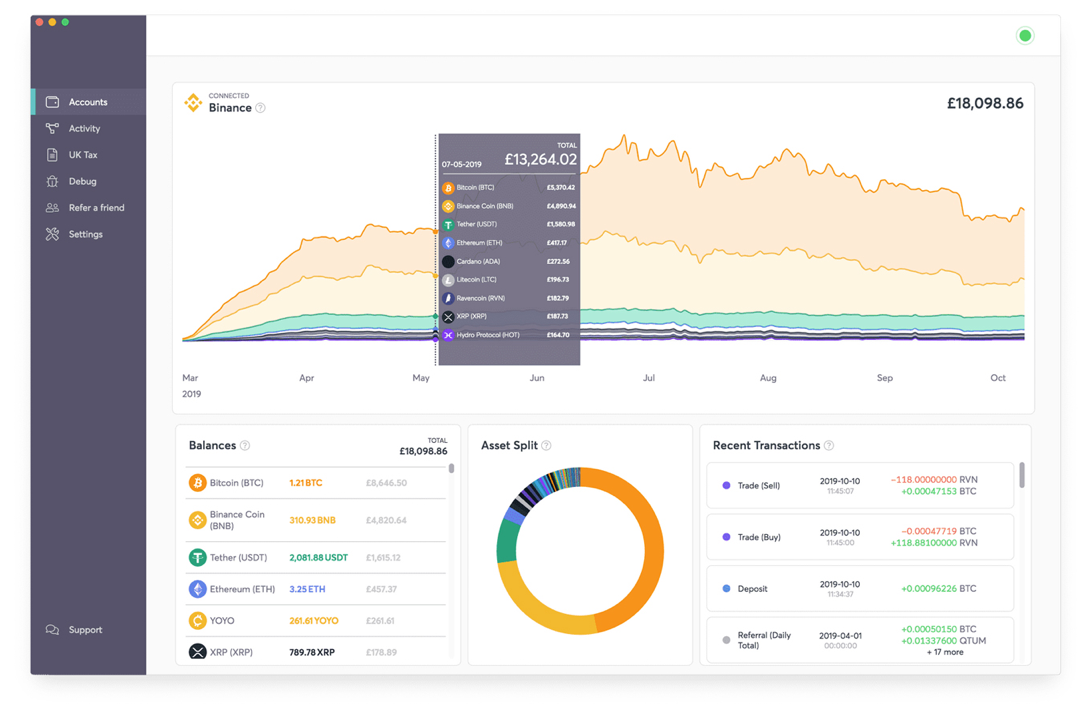

Crypto is taxed in the same way as Gold and real estate. The cryptocurrency tax calculator handles this automatically using your investment and trading history. Check out our UK tax guide for information for UK individuals.

If this is in the higher rate or additional rate tax band youll pay 20 on your capital gains from crypto. The original software debuted in 2014. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep.

Crypto tax calculator is one of them designed specifically for hmrc tax laws. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax.

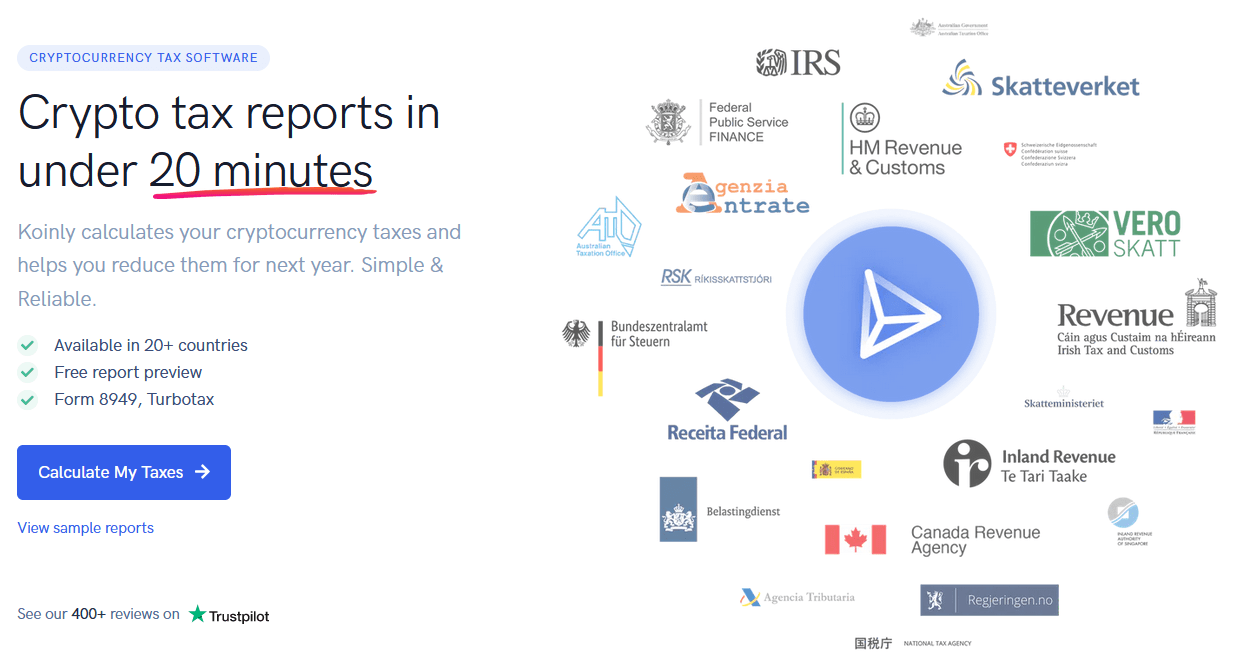

Your first 12570 of income in the UK is tax free for the 20212022 tax year. Capital gains tax CGT breakdown. We offer full support in US UK Canada Australia and partial support for every other country.

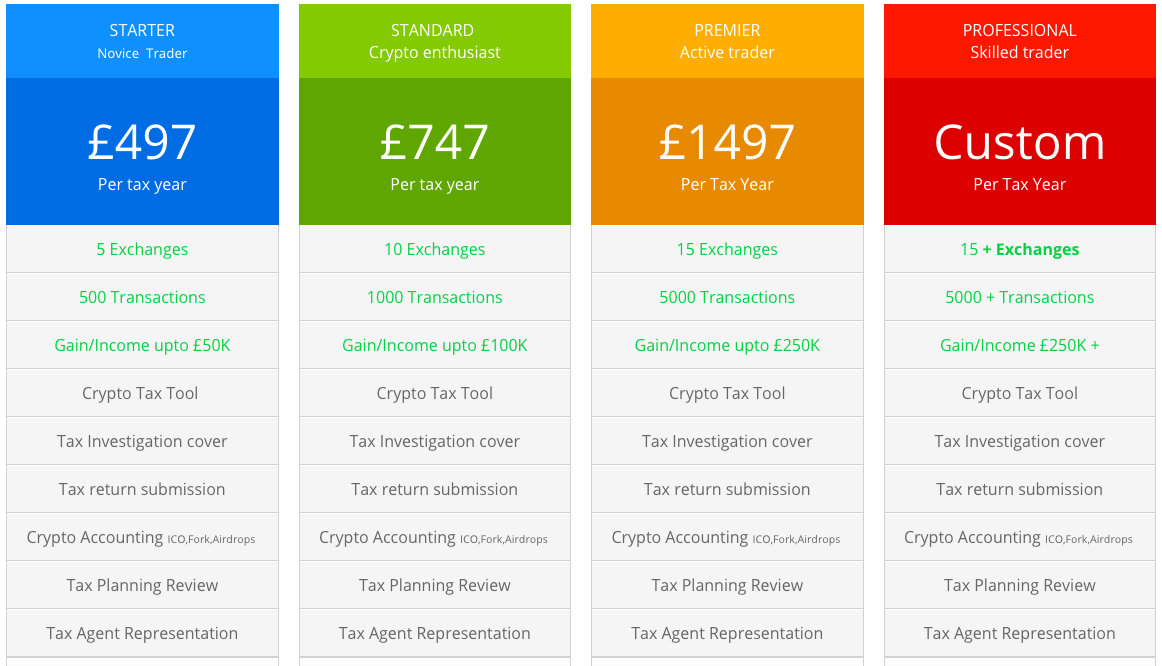

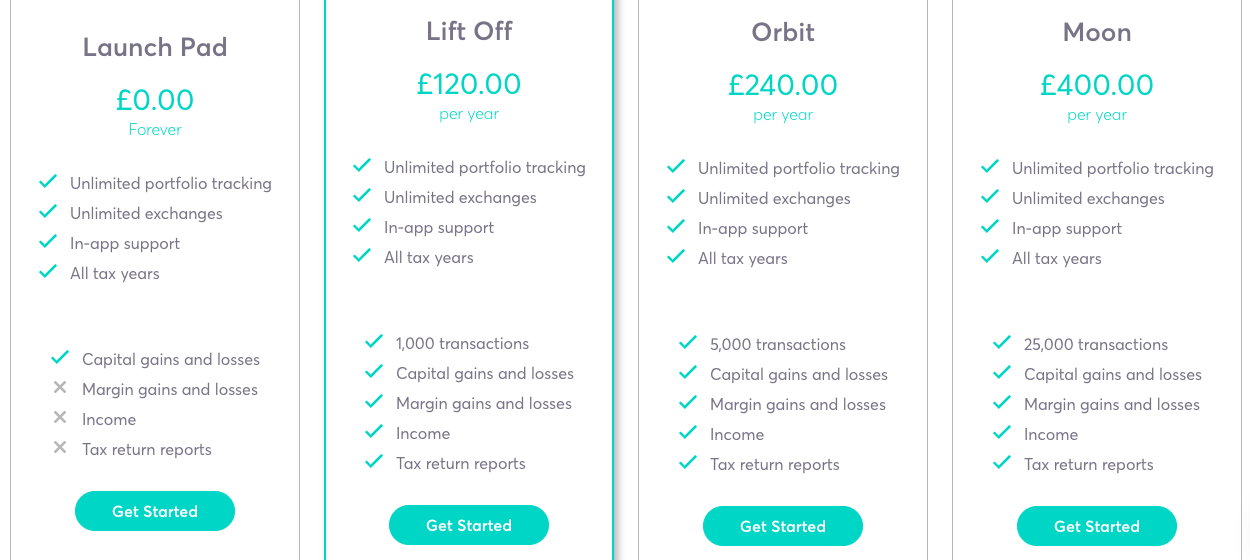

Unlike many calculators the Crypto Tax Calculator isnt free. It offers four pricing options including. Stop worrying about record keeping filing keeping up to date with.

When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for minus any exchange fees. If activities are considered trading they will face different cryptocurrency tax in the UK. If youve sold traded earned or spent cryptocurrency then you do need to calculate if you owe any tax.

You pay Capital Gains Tax when your gains from selling certain assets go over the. Since then its developers have been creating native apps for mobile devices and other upgrades. With more than 15K customers this crypto tax calculating application simplifies crypto tax to investors and tax professionals.

In your case where your capital gains from shares were 20000 and your total annual earnings were 69000. If this is within the basic income tax band youll pay 10 on your capital gains from crypto. The Crypto Tax Calculator boasts over 400 integrations more than 60000 users and has reportedly been utilized for over 120 million transactions.

You pay no CGT on the first 12300 that you make. Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. Crypto Tax Calculator is one of them designed specifically for HMRC tax laws.

Amount and currency of the coin or token sold Fiat value at the time of acquisition. For individuals income tax supersedes capital gains tax and applies to profits. HMRC doesnt consider cryptoassets to be a form of money whether exchange tokens utility tokens or security tokens.

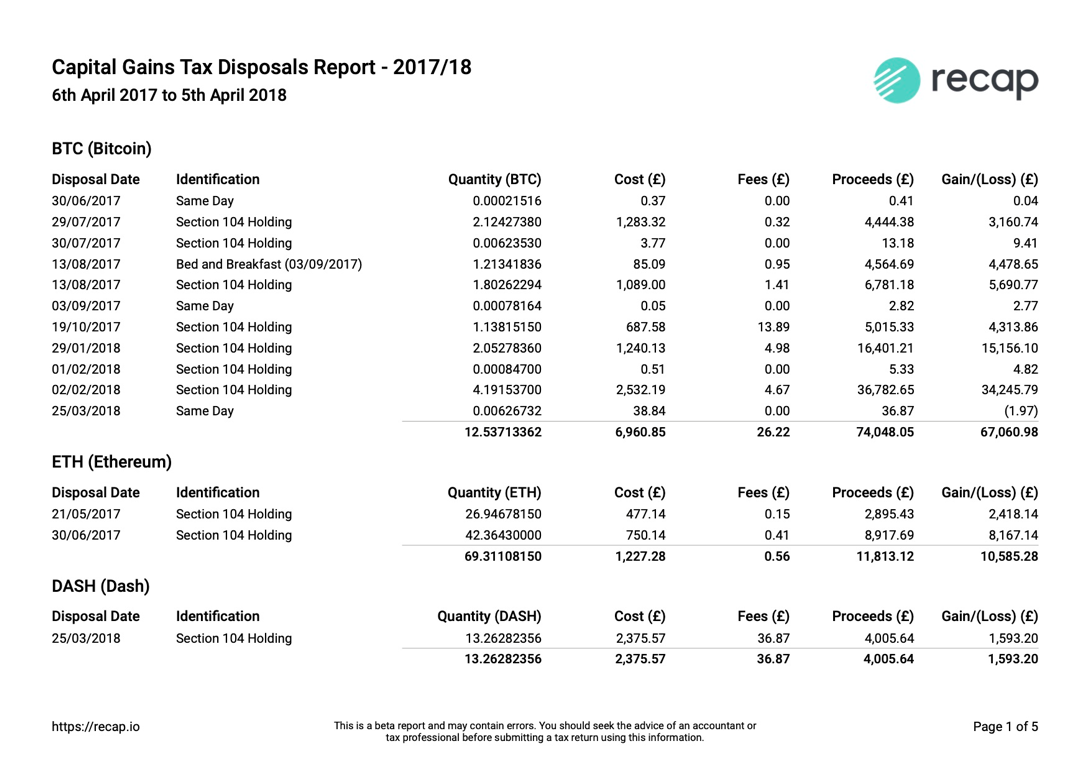

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. Calculate your gains by applying same day 30 day and asset pooling rules. Tax on this cryptocurrency exchange in the UK will include capital gains tax.

Youll need your transaction history in order to track your tax lots. UK capital gains and income tax support. This tool is designed to be used by someone who is already familiar with cryptoasset taxation rules in the UK.

From a tax perspective investing in cryptocurrency is very similar to investing in other assets like stocks bonds and real-estate. This matters for your crypto because you subtract this amount when calculating what.

![]()

Cointracking Crypto Tax Calculator

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

.jpg)

The Definitive Guide To Uk Crypto Taxes 2022 Cryptotrader Tax

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Crypto Taxes With Ease Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Wade S Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazon Co Uk Software